Agency accounting–the least talked-about department of any marketing firm—in reality supports every aspect of its growth and continued success.

Do you have invoices and spreadsheets filled with incomprehensible numbers piling up on your desk? With the worry of tax season at the door, we understand that accounting is a necessary evil for many marketing agency owners.

Imagine if your accounting system could be more simplified, effective, and powerful. What if it could give real-time insights that drive strategic decisions, free up your team’s time, and accelerate your agency’s growth?

If your current advertising agency accounting methods feel like a haphazard obstacle course rather than a streamlined path to higher profits, this blog is for you.

Continue reading to explore our most recommended tips and tricks, step-by-step processes, and tools to optimize your agency’s accounting strategies.

Why is Accounting Important?

Generally, mind-blowing campaigns and out-of-the-box ideas regarding marketing agencies always steal the show. Aren’t we right?

However, accounting, a core pillar of agency success, helps ensure that these creative efforts continue to drive results without fail.

That said, here’s why accounting for marketing agencies is essential now more than ever:

Setting the Right Price For Your Services

Although every client deserves high-quality service, charging less for what you bring to the table could leave the agency feeling undervalued.

Accounting helps estimate your actual service charges—not just operational costs like software tools but also overhead costs like workspace, staff benefits, etc. Digital marketers can accurately price their services with correct cost data to acquire profits and client satisfaction.

Management of Agency Resources

From creating viral social media content to unique websites that grab attention, agencies do everything relying on their resources—employee salaries, tools/software, and ad spending budgets included.

With proper accounting practices, owners can ensure their resources are always available, tracked, and strategically spent. This is because accountants keep track of all costs and prepare fiscal budgets to avoid disrupting or depleting their agency resources.

Making Smart, Data-Driven Decisions

While creativity is vital to marketing, it’s all ineffective without logic.

Accounting provides data-driven insights that drive smart decision-making. Agency owners can learn what performed, what didn’t, and where to make improvements for the future by analyzing previous efforts.

Moreover, with this data, marketers can deeply understand their target market and personalize their advertising campaigns for the best results.

Establishing Trust and Reputation

As the saying goes, numbers don’t lie.

Maintaining clear and transparent financial records ensures tax compliance and demonstrates reliability and ethics to clients. In essence, agencies that follow strong accounting practices create trust and cement their reputation as trustworthy partners.

Top Tips and Tricks For Strong Agency Accounting

Top Tips and Tricks For Strong Agency Accounting

A healthy bottom line lays the ground for creative freedom and long-term growth. That being said, here are our best tips and tricks for managing your agency’s finances like a boss:

Implement the Profit First method

Take the first step towards change; instead of chasing revenue, aim for profit.

At Prospecting On Demand, we recommend that growth-driven entrepreneurs keep a certain percentage of their agency’s income (preferably 15-20%) aside into separate accounts for profit, taxes, and owner’s pay.

Here’s why: Separating the finances helps ensure you invest in wealth creation and secure your financial future rather than just making money. Don’t even think about touching these accounts unless absolutely needed―especially, avoid using them for day-to-day spending. You’ll be shocked at how quickly your agency’s long-term growth and economic health begin skyrocketing if you put profit first.

Learn more about Prospecting On Demand’s programs on how to build a high-profiting agency structure.

Timely invoicing and accurate estimates

The days of mailing invoices at month’s end and hoping for the best are gone.

Speed and accuracy—surviving in today’s competitive landscape will be challenging if your agency lacks these qualities. Our tip? Set up an invoice generation system to produce bills as soon as the work is finished, preferably in less than 24 hours. Automating these tasks helps maintain a steady flow of funds and reduces payment delays.

By the way, don’t forget to improve your ability to estimate project costs. Analyze previous projects, account for all potential expenses, and provide clear, realistic quotations to avoid unwanted surprises down the road.

While overestimating project costs may turn away clients, underestimating your charges will slash your profits.

Updating accounts and leadership

Clear communication is the cornerstone of any successful team; the accounting and leadership relationship is no exception.

Never make the mistake of leaving your finance team to the back office. We highly recommend leadership to understand the company’s financial standing proactively.

Your finance team must share periodic reports highlighting critical metrics like revenue, expenses, and profit margins. Thanks to such data and transparency, leaders can better allocate resources, make more well-informed decisions, and modify growth strategies in light of accounting data.

Leaders, your advertising agency accounting team is more than just a team of number crunchers. Remember, they’re the only ones who can translate complex financial data into useful, actionable info for the entire agency.

Ensuring tax compliance

We agree that taxes aren’t anybody’s favorite part about running a six or seven-figure marketing agency. However, doing nothing about them can also be catastrophic.

This goes without saying—tax planning and compliance are critical for any business’s long-term growth, whether it’s marketing or fast food. Start viewing taxes as a core investment rather than a burden; it will save you time and money in the long run.

Partner with a qualified accountant or tax advisor who can guide you through the complex world of tax regulations and keep you safe from legal controversies. By doing this, you avoid fines and penalties and gain credibility and confidence from stakeholders and clients.

How to Set Up Your Accounting Department

Our finance coaches at Prospecting On Demand have shared a detailed breakdown of each step in building a solid financial foundation for any highly profitable digital marketing agency.

Transitioning from spreadsheets to cloud accounting software

Are you still managing endless spreadsheets, clumsy formulas, and laborious data entry? That’s a big no if you ask us.

For marketing agencies today, cloud-based accounting software is nothing short of a breakthrough. These platforms simplify workflow and remove time-consuming tasks by seamlessly integrating with payroll, invoicing, and project management software.

Real-time financial insights, secure data storage, collaborative access for your team, automated reports that provide a clear picture of your agency’s financial health—the list of reasons software is a must-have is endless.

It would be great to have your accounting department started on the cloud ASAP with a reliable cloud accounting platform.

Creating an effective agency accounting tech stack

Your accounting tech stack must be well-planned, with each instrument contributing to financial strength.

Invest in the following necessary tools alongside your cloud accounting software:

- Project management tools (Asana/Trello) to track project progress, budget allocation, and billable hours, ensuring accurate cost calculations & prompt invoicing.

- CRM software, such as HubSpot or Salesforce, to manage customer connections, track prospects, and gather insightful data for smart decision-making.

- Secure payment processing gateways like Stripe or PayPal into your invoicing system for easier online payments and faster cash flow.

- Expense tracking tools like Expensify or Zoho Expense capture receipts on the fly, automatically classify expenses, and avoid the dreaded shoebox of receipts.

Choosing between cash or accrual accounting

Choosing the most effective accounting method to run your marketing agency may seem complex, but it is worth the effort.

Regardless of real cash flow, accrual accounting records revenue when it is received and expenses when they are incurred. Cash accounting, on the other hand, only documents income and expenses when cash is exchanged.

Regarding long-term projects or retainer fees, accrual accounting provides most agencies with a more accurate view of your financial situation. Cash accounting, however, is a clear winner if your company is small or mostly runs on cash.

Play it safe—speak with an accountant to weigh the benefits and drawbacks of every method and select the one that suits your requirements the best.

Identifying key financial metrics to track

Financial metrics guide you to make smart decisions and acquire strategic growth, and here’s a list of key metrics you should identify to track:

Profit Margin

As the name suggests, it measures the profitability of your services. To calculate, divide your net income by the total amount of revenue. Aim for a good margin to keep your agency afloat and encourage reinvestment.

Client Acquisition Cost (CAC)

Next up, this metric measures the cost of obtaining new customers. If yours is too high, analyze your marketing and sales channels to find low-cost customer expansion tactics.

Days Sales Outstanding (DSO)

This metric measures the average time it takes to receive payment from customers. If you’re not focused on enhancing DSO, your chances to increase financial stability and cash flow more quickly become thin.

Burn Rate

Last but not least, your burn rate shows how rapidly the funds in your marketing agency are being used. Always monitor your burn rate to maintain long-term operations and spot any cash flow difficulties early.

Regular monitoring of essential financial reports

Financial health isn’t a sprint but a long marathon of continually monitoring, evaluating, and adapting.

Set aside time each month to evaluate your major financial reports, such as income statements, balance sheets, and cash flow statements. This way, you can spot possible areas of concern early on, make suitable budgetary adjustments, and reverse course before they snowball into larger issues.

Learn how to set up and manage your marketing agency’s accounting from the ground up. Sign up for Prospecting On Demand’s coaching programs.

Top 3 Advertising Agency Accounting Software Choices

Looking for the right software for accounting in marketing agencies? Check out POD’s top three picks:

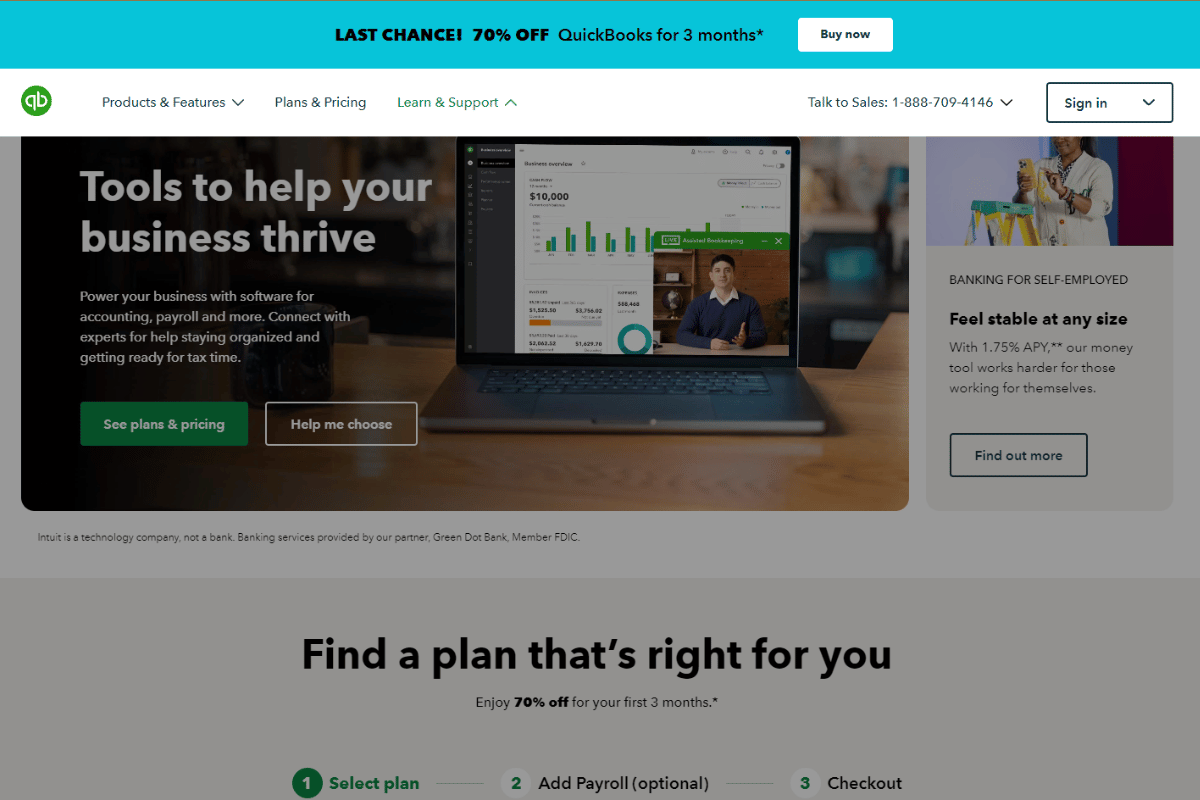

1. Quickbooks

Our #1 pick, QuickBooks, doesn’t need an introduction.

It is undoubtedly the most efficient accounting software available for small companies. It has a feature-rich layout, easy interfaces with well-known programs like PayPal and Gusto, and a user-friendly interface.

QuickBooks can be a reliable and cost-effective choice for agencies just starting or with basic financial requirements. Teams used to standard accounting processes will also find it easy to use and familiar.

However, QuickBooks is known to struggle with complex project-based accounting and may lack the advanced analytics and reporting features required by larger organizations.

That’s where our other top picks come in.

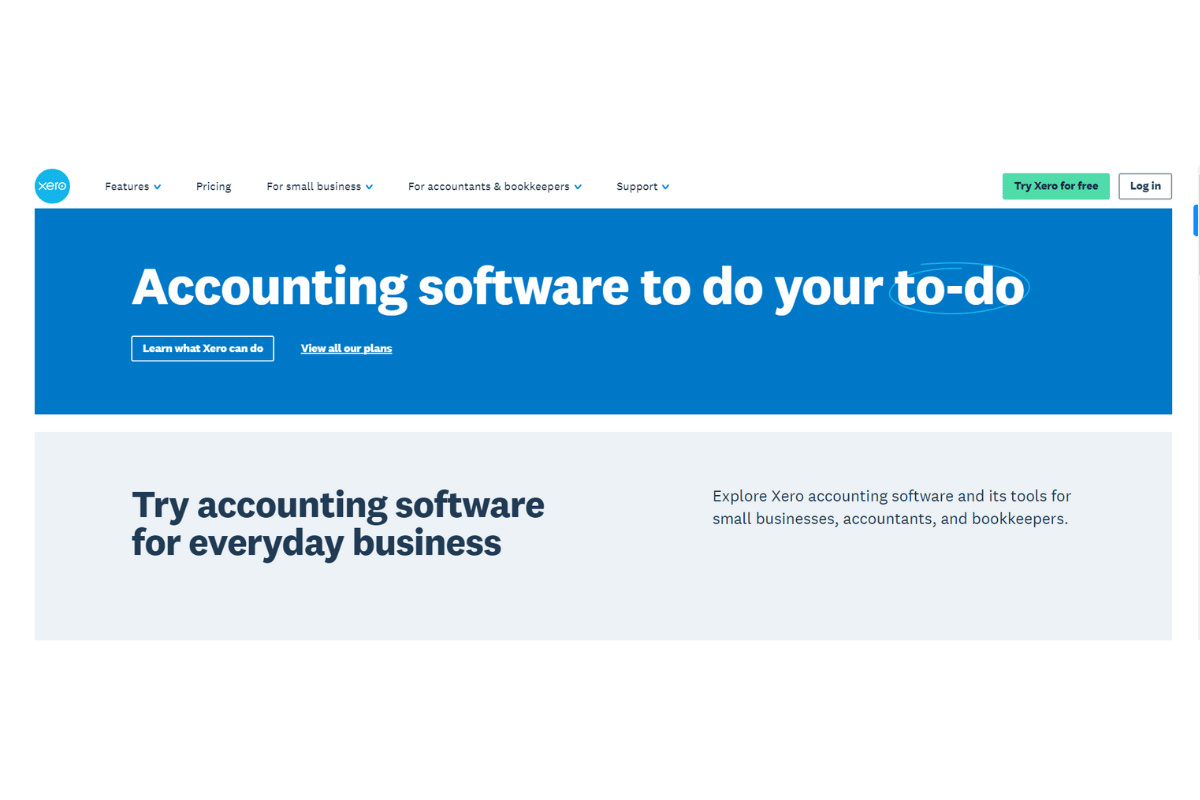

2. Xero

Next on our list is Xero, a cloud-based software with user-friendly interfaces, seamless integrations with key marketing platforms like Slack and Hubspot, and extensive project management capabilities like:

Project Costing and Tracking

Project cost and spending tracking—this is truly where Xero shines. It makes assigning resources, creating budgets, and keeping track of billable hours easier than ever, guaranteeing great project profitability and customer billing.

Automation and Collaboration

Xero makes team communication more manageable by providing real-time data access and automated workflows. This feature allows project managers, finance teams, and clients to access critical financial data, shorten approval processes, and improve invoicing.

Flexibility and Scalability

The best part is that Xero actually grows with your business. It supports various entities and currencies, making it perfect for agencies entering new markets or managing different client portfolios.

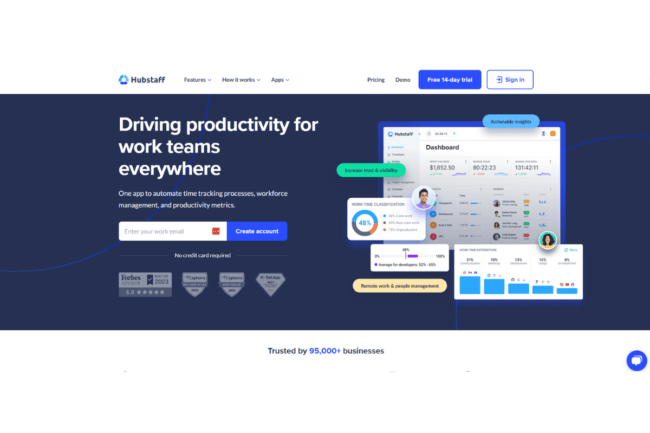

3. Hubstaff

Hubstaff, our final pick, is more like an agency’s all-in-one project management and accounting hub, best known for optimizing workflows and improving team cooperation.

With this software, owners can see a real-time picture of their agency’s financial health with features like time tracking, project planning, and invoicing that easily combine with powerful financial reporting tools.

For marketing firms, Hubstaff offers these exclusive features:

- Project profitability tracking by visualizing each campaign’s financial performance to identify profitable regions and areas for improvement.

- Simplifying the payroll process by integrating with current payroll providers/setting up automated payments for freelancers.

- In-app expense tracking of costs straight from any mobile device to reduce manual data entry errors and ensure accurate expense reporting.

Finding the Right Support

Finding the Right Support

What type of support would you need to set up accounting in your marketing agency? Here’s a brief comparison:

Accountant vs. CPA

An accountant usually offers insightful financial insights and is ideal for routine accounting duties. Typically, they have a bachelor’s degree in accounting.

On the other hand, a Certified Public Accountant (CPA) is even more skilled and credible, as they’ve fulfilled all licensing requirements and cleared an examination.

An accountant is an excellent place to start for new agencies, as they can manage everyday tasks, like accounts payable and receivable, payroll, and basic financial reporting. However, consulting with CPAs is necessary for companies handling complex financial transactions, frequent audits, and expert tax planning.

Accountant vs. Bookkeeper

Bookkeepers conduct daily data entry of financial transactions, guaranteeing correctness and completeness. They classify expenses, reconcile bank transactions, and create source papers for tax filing.

Although they both deal with statistics, bookkeepers and accountants have somewhat different jobs. An accountant analyzes the bookkeeper’s data and provides insights, creates reports, and oversees the agency’s financial health, apart from more complex activities.

For small-scale agencies with simple finances, hiring a professional bookkeeper can work. But as the business expands, owners need an accountant to help with data analysis, report writing, and financial counseling.

Controller vs. Accountant

Controllers are the CFOs responsible for overseeing the finance department and advising leadership.

Accountants may oversee but do not bear total financial responsibility. Instead, they manage specialized duties like taxes or salaries. Large agencies require controllers for accuracy, efficiency, and compliance, although smaller organizations usually get by with trained accountants.

In short, controllers oversee large-scale financial matters, whereas accountants specialize in particular areas within that system.

Frequently Asked Questions (FAQs)

Curious to learn more? Have more questions? Here’s a list of the most FAQs about agency accounting:

What are the challenges of good accounting for agencies?

Balancing project costs, managing several revenue streams, and navigating complex client billing arrangements can be challenging.

Simultaneously, keeping up with tax requirements and implementing effective accounting systems can make it even more difficult.

Can small agencies benefit from outsourced accounting?

Absolutely! Outsourcing makes bookkeeping easy, guarantees compliance, and offers access to expert financial advice.

For small organizations, it can be a cost-effective method to achieve excellent financial standards without wasting essential resources.

Conclusion

Optimizing your agency accounting is not a luxury but a need.

By implementing the strategies discussed above, you can easily handle your agency’s financial complexity. You can also gain essential insights to drive growth and strengthen your agency’s competitive edge with better-quality data.

There has never been a better time to take control of your finances. Explore how our programs can help you scale your agency to 6-7 figures, offering strategic insights and tools.

Prospecting On Demand focuses on overall growth for agency owners. Therefore, we will guide you through establishing a solid accounting system for your agency.